unrealized capital gains tax canada

Donate your shares to charity. 6 Ways to Avoid Capital Gains Tax in Canada.

The Democrats Wealth Tax Mirage Wsj

6 Ways to Avoid Capital Gains Tax in Canada.

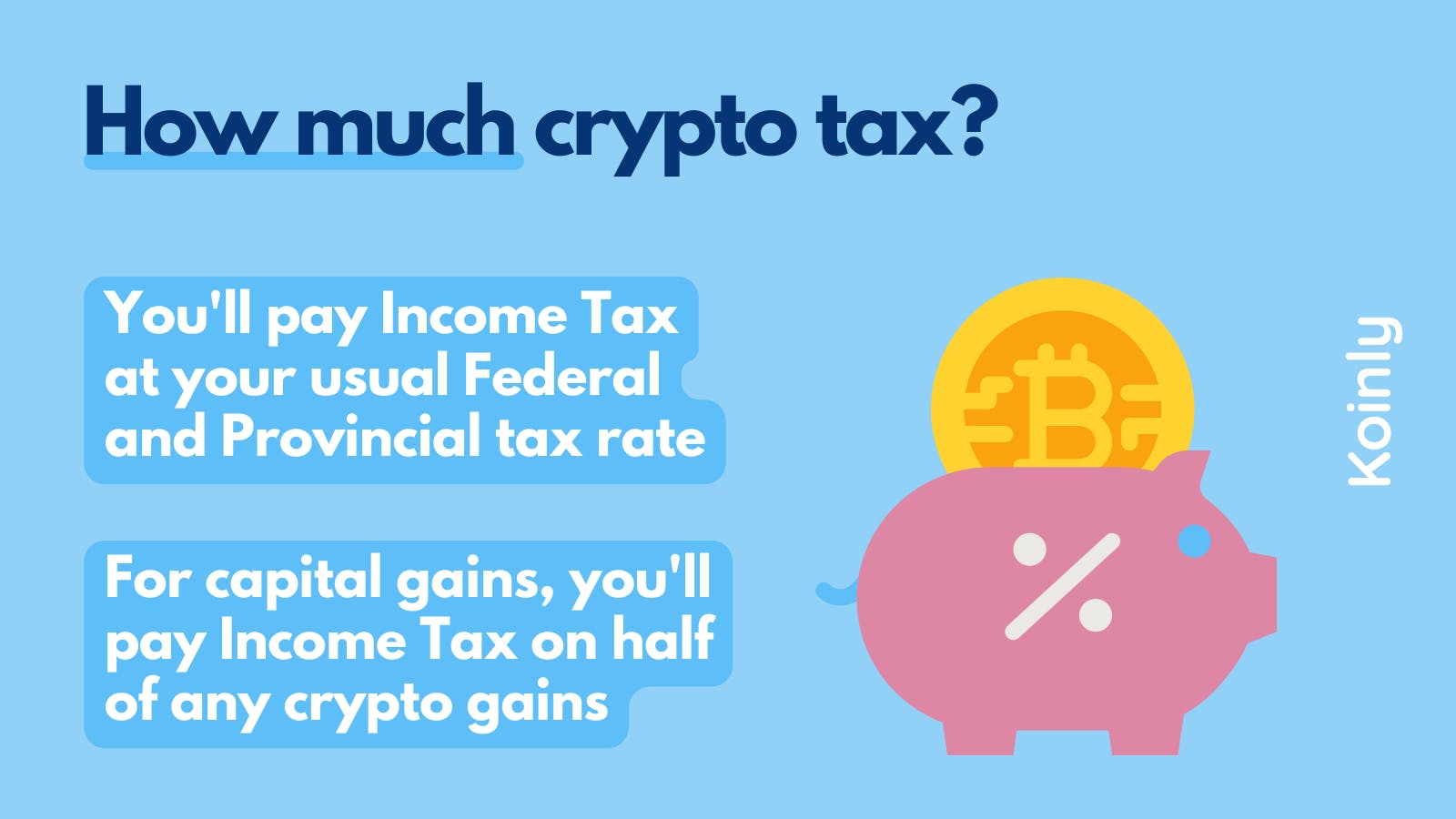

. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. If the equity investment value increases you must pay capital gains tax. The CRA allows taxpayers to defer their capital gains tax burden by up to three years meaning you can defer either your losses or your gains to years when it will have the.

Below is how the federal tax brackets break down for the 2021 tax year. Donate your shares to charity. Lifetime capital gain exemption.

Donate your shares to charity. Donate your shares to charity. Capital gains meaning earnings from selling an asset for more than you bought it are taxable under federal tax law.

If you decide to sell youd now have 14 in realized capital gains. 6 Ways to Avoid Capital Gains Tax in Canada. Ad Browse Discover Thousands of Book Titles for Less.

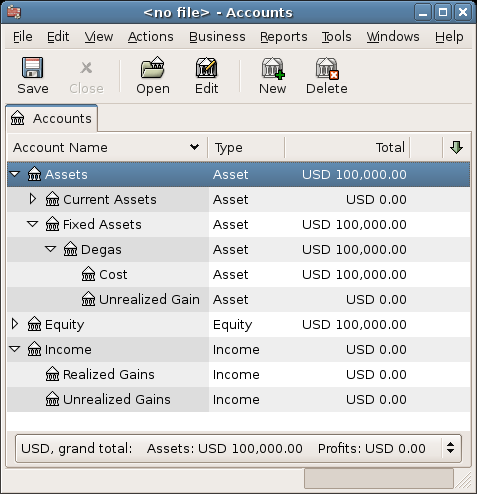

Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. Lifetime capital gain exemption. 7950 2400 5550.

Donate your shares to charity. Lifetime capital gain exemption. This means you have a capital gain because its more than your ACB.

As the foreign exchange of the account balance will fluctuate after the year-end it is considered unrealized. Deduct this ACB from the sale price. In Canada 50 of your capital gain is taxable.

Lifetime capital gain exemption. When to report a gain or loss. 4 The effective marginal tax rate of 195 per cent incorporates the inclusion rate of.

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. As a result an adjustment may be required on Schedule 1 of the. Capital gains are in two categories.

For example if you buy a. The capital gains tax only applies to realized capital. 6 Ways to Avoid Capital Gains Tax in Canada.

6 Ways to Avoid Capital Gains Tax in Canada. You report the disposition of capital property in the calendar year January to December you sell or are considered to have sold the property. Non-resident corporations are subject to CIT on taxable capital gains 50 of capital gains less 50 of capital losses arising on the disposition of taxable Canadian property.

A stock or piece of. Lifetime capital gain exemption. Adjusting for inflation 40000 in taxable income in 1994 is equivalent to 63685 in 2020.

The Exit Tax When Moving From The U S To Canada

Americans Exiting Canada Understanding The Five Year Deemed Disposition Rule Ebook

Biden Expresses Support For Annual Tax On Billionaires Unrealized Gains Wsj

Opinion This Plan To Force The Wealthy To Pay Yearly Capital Gains Taxes Won T Solve The Real Problem Marketwatch

Crypto Tax Loss Harvesting Investor S Guide Koinly

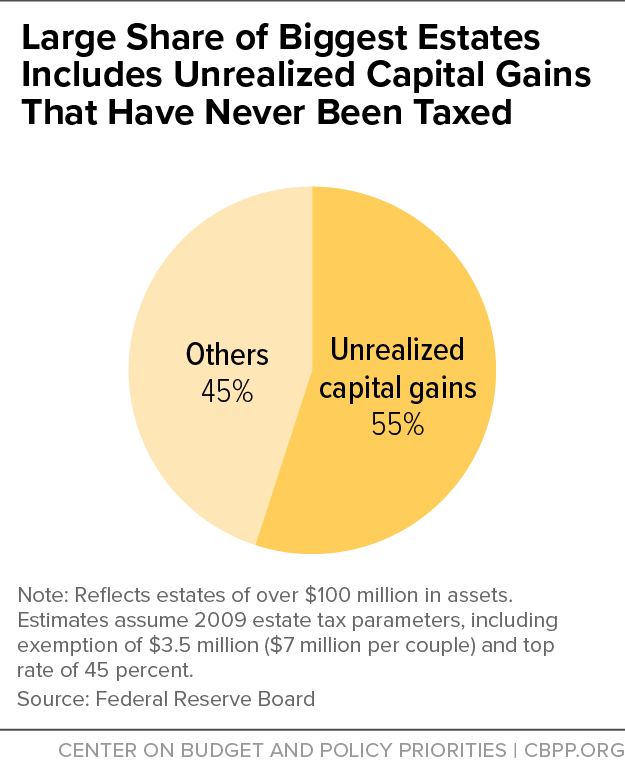

Large Share Of Biggest Estates Includes Unrealized Capital Gains That Have Never Been Taxed Center On Budget And Policy Priorities

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Northern Trust Wealth Management Asset Management Asset Servicing

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax International Liberty

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Top Democrat Proposes Annual Tax On Unrealized Capital Gains Wsj

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Canada Crypto Tax The Ultimate 2022 Guide Koinly

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains R Cryptocurrency